Do Crypto Assets Help As Crisis Protection?

Do Crypto Assets Help As Crisis Protection?

Considering the current market and macro-environment, as well as past crises, it would make sense for an investor to better understand whether crypto assets can help protect their portfolio against negative market movements in times of crisis. Bitcoin, the “digital gold,” in particular, is of interest here. In this article, we, Felix Fernandez and Maximilian Bruckner from 21e6 Capital, want to explore whether crypto assets actually offer protection in times of crisis. For this, we calculate and analyze the correlation between Bitcoin and the global stock market, and pay particular attention to the corona crisis of March 2020.

Authors: Maximilian Bruckner, Felix Fernandez

Bitcoin in the Corona crisis, March 2020.

The time window we can use to analyze crypto assets is still quite short; Bitcoin as the oldest cryptocurrency went online in January 2009. Thus, one cannot make any statements about correlations during the 2008 financial crisis; in fact, the Genesis Block (first block of the Bitcoin blockchain) contains the dated title of a Times newspaper article: "The Times 03/Jan/2009 Chancellor on brink of second bank bailout." It is often speculated whether Satoshi Nakamoto launched the Bitcoin network as a direct response to the financial crisis. With this in mind, then, it would stand to reason that Bitcoin was possibly intended as a "way out" of the centralized financial system, and thus to also provide a secure crisis protection.

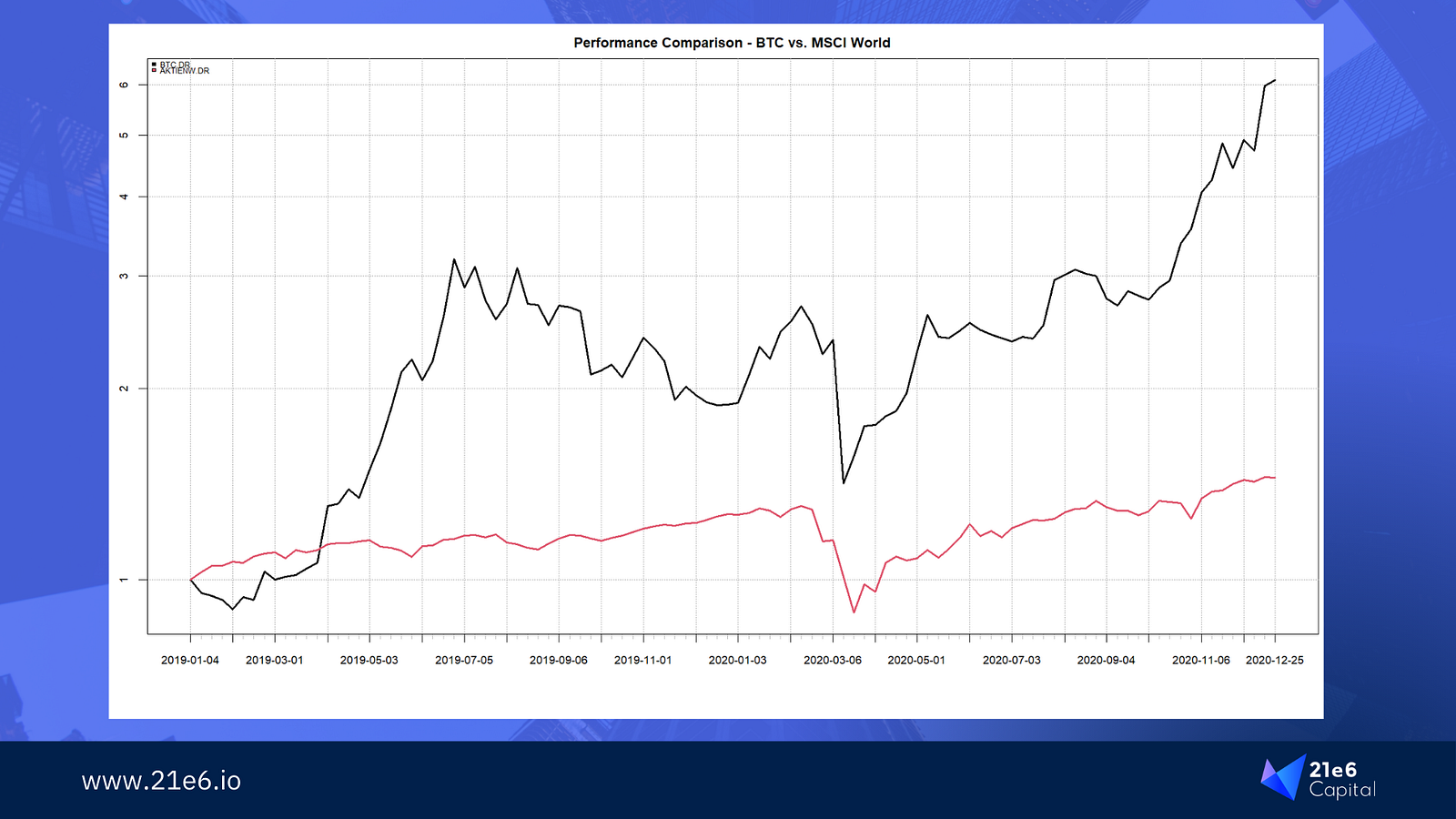

The only notable crisis we've seen since the creation of Bitcoin is the Corona crisis of March 2020. Within only a few days, the global stock market dropped over 30% - the largest and fastest downward movement since the 2008 crisis. We use the MSCI All Country World Index as a representation of the global market, and compare it with Bitcoin. Figure 1 shows their respective performance during 2020.

Figure 1: MSCI All World Index & BTC Performance 2020 (Source: MSCI / CoinGecko)

Figure 1: MSCI All World Index & BTC Performance 2020 (Source: MSCI / CoinGecko)

During this period, crypto assets would not have been a good hedge. Bitcoin as the largest cryptocurrency (the crypto market is strongly positively correlated with Bitcoin) lost about 50% here, see Figure 1. So, at first glance, it seems that crypto assets do not add value, at least in the context of diversification as crisis protection. However, there are a few more factors to consider.

Correlations are only of limited significance

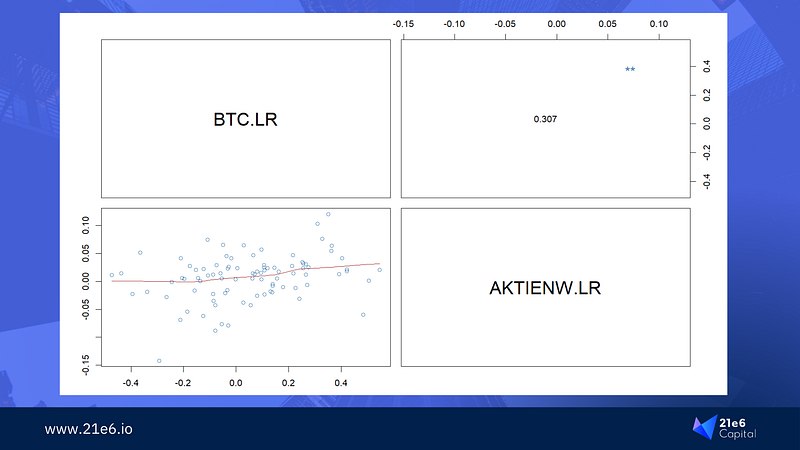

The correct interpretation of correlations is not entirely trivial. Let us explain. If we first observe the correlation between Bitcoin and stocks over a longer period of time (from 2014 to today), it appears to be quite low. Figure 2 shows the correlation of Bitcoin with the global stock market over the period from 2014 to 2022. The mean correlation is about 0.3, and at the bottom left you can see the monthly data points and correlation represented visually.

Figure 2: Correlation between Bitcoin and global equities. Source: 21e6 Capital

Figure 2: Correlation between Bitcoin and global equities. Source: 21e6 Capital

On average, only a slightly positive correlation can be seen - so one could still conclude that one would achieve some diversification effect by adding Bitcoin to a world equity portfolio. The question now is whether this will persist in times of crisis. Unfortunately, this is not the case; there are two effects that severely limit the diversification benefits.

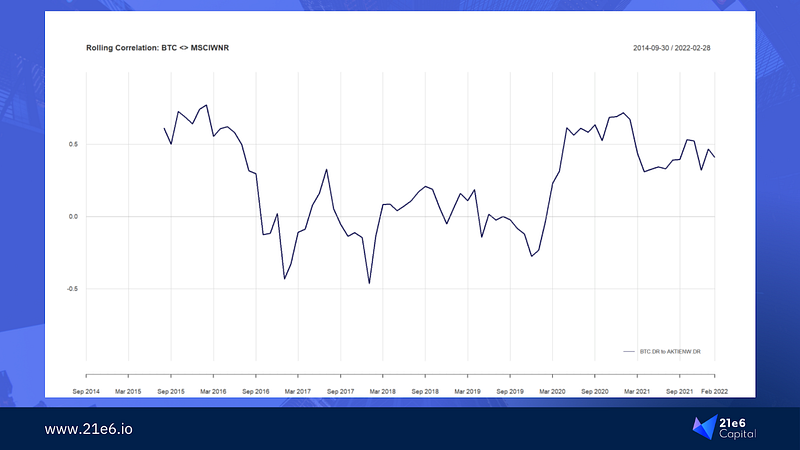

First, the correlations between Bitcoin and the stock market are not stable. In fact, they change over time. If we examine the correlation between Bitcoin and global equities on a rolling basis, it becomes obvious that the correlation fluctuates greatly. In Figure 3, one can easily see that there are phases when the correlation tends toward zero, while in other phases it increases significantly. In March 2020 (at the beginning of the Corona crisis), one can see a rapid increase to a positive correlation above 0.5, while from 2016 to 2019 it fluctuated in the range of -0.5 to about 0.4.

Second, the experiences of recent financial crises show that correlations between different asset classes in general increase significantly during a crisis. This is not only true for Bitcoin and the stock market, but for almost all asset classes. The phenomenon could also be observed in 2008: Investors are looking for a "safe haven" in liquidity, and in addition, automated loss limits (stop-loss) are often breached. This ensures the systematic sale of larger volumes and thus drives market prices down further. So the question arises whether diversification into other asset classes makes sense at all in times of crisis. Nevertheless, the answer is a resounding yes. By adding other asset classes (such as gold, real estate, bonds) you can significantly dampen negative market movements for your own portfolio. For example, gold prices also declined during the March 2020 crisis (about -13%), but nowhere near the same magnitude as Bitcoin and equities.

It still makes sense to add crypto to a portfolio

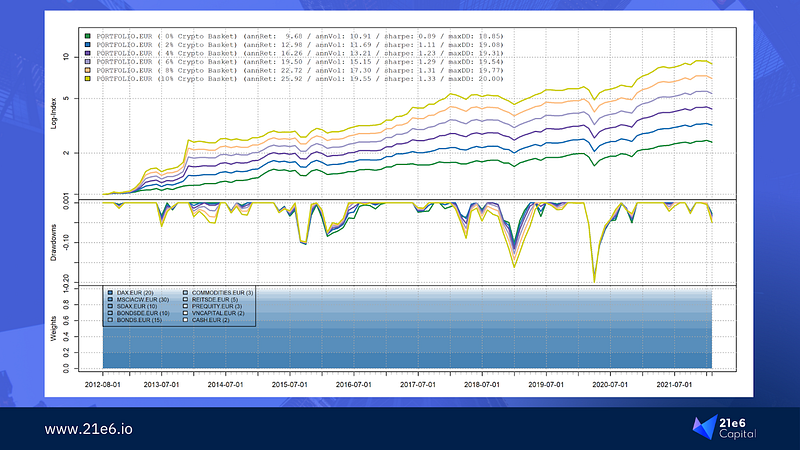

Even though crypto assets do not offer direct protection against negative market movements in times of crisis (at least according to previous observations), one should by no means take from this article that crypto assets cannot add value at all. On the contrary, the high risk-adjusted return (Sharpe ratio) characteristics of crypto assets can significantly improve the characteristics of a portfolio! Figure 4 shows the impact of a naïve crypto addition (cap-weighted; Bitcoin, Ethereum, Binance Coin, Cardano, Solana, Ripple, Polkadot, Litecoin, Uniswap, Bitcoin Cash) on a standard portfolio consisting of 60% stocks, 30% bonds, and 10% alternatives.

The analysis shows that small to moderate crypto exposure (2–4%) has a mostly positive effect. With only 2% exposure, returns increase significantly, while volatility and drawdowns change only minimally. Accordingly, the risk-adjusted return (Sharpe ratio) improves: from 0.9 to 1.1.

Conclusion

It seems Bitcoin and other crypto assets do not offer good crisis protection. In fact, only a conservative, strategic allocation will help here. For meaningful crisis protection, one should structure a well-diversified portfolio across multiple asset classes and provide sufficient liquidity buffers so that one does not have to liquidate one's portfolio in times of crisis when market prices are low. Since crypto assets have a positive impact on a portfolio in small proportions, they should not be missing as a component of a well-diversified portfolio.

Remarks

This article is an informational document and does not constitute an investment recommendation, investment advice, legal, tax or accounting advice or an offer to sell or a solicitation to purchase any securities and therefore may not be relied upon in connection with any offer or sale of securities. The views expressed in this letter are the subjective views of 21e6 Capital personnel, based on information which is believed to be reliable. Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding accuracy or completeness of any information or analysis supplied.

If you like this article, we would be happy if you forward it to your colleagues or share it on social networks. If you are an expert in the field and want to criticize or endorse the article or some of its parts, please feel free to leave a private note here or contextually, and we will attempt to respond or address the same.

About 21e6

21e6 Capital is a Swiss investment advisor, connecting professional investors with optimal crypto investment products. 21e6 Capital has analyzed over 1,000 crypto funds across the world and condensed them into a selection that can yield crypto-exposure with minimized downside risk. Backed by a highly experienced team of crypto and finance experts with in-depth knowledge in digital assets and DLT, 21e6 Capital created a unique quantamental strategy that is aimed at achieving crypto-like returns while minimizing risk and volatility to global equity levels. The 21e6 Capital team builds upon strong academic roots with a track record of leading crypto asset and decentralized finance publications and research, ensuring state-of-the-art crypto investment solutions for financial industry professionals.

Authors

Maximilian Bruckner is Head of Marketing & Sales at 21e6 Capital AG. Prior to this, he was engaged as Executive Director of the International Token Standardization Association (ITSA) where he focused on research and classification of crypto assets according to the International Token Classification (ITC) framework. He was heavily involved in the creation of the world’s largest token database for classification and identification data on tokens (TOKENBASE). Maximilian did academic research in close consultation with Prof. Dr. Philipp Sandner. You can contact Maximilian via e-mail at maximilian.bruckner@21e6.io to request more information on 21e6 Capital AG or ask any questions regarding this article. You can also follow Maximilian on LinkedIn (https://www.linkedin.com/in/max-bruckner/) to stay up to date.

Felix Fernandez has recently taken on the role of CEO of 21e6 Capital AG. Felix works in parallel as CEO for OpenMetrics Solutions in Zurich. He has more than 20 years of experience in the financial industry and previously held top management positions at Deutsche Börse Group. After a long career in the corporate customer business, he joined the Rmetrics Association in 2016 as a research fellow led by Prof. Diethelm Würtz at ETH Zurich. In the same year, he co-founded OpenMetrics Solutions as an ETHSpinoff. Felix holds a degree in computer science.

You May Also Like

These Related Articles